Featured

How Do Tax Cuts Help The Economy

Calling it a budget to rebuild our economy and secure Australias recovery Treasurer Josh Frydenberg has pledged a raft of key changes including ongoing tax relief for Australian workers. That has been seen as a positive trend in the employment data.

Separating Economic Facts From Fiction On The Trump Tax Cuts The Heritage Foundation

Separating Economic Facts From Fiction On The Trump Tax Cuts The Heritage Foundation

People who want to consume more can use their tax cut for that purpose.

How do tax cuts help the economy. Heres how tax cuts affect the economy. As a result tax cuts improve the economy in the short-term but if they lead to an increase in the federal debt they will depress the economy in. The prospect of the tax cut benefits are obviously providing some underpinning for hiring.

Thats because they will initially. 1 As a stimulus measure designed to support the economys recovery and build on the. One of the key announcements for workers in the 2021-22 Federal Budget was income tax cuts.

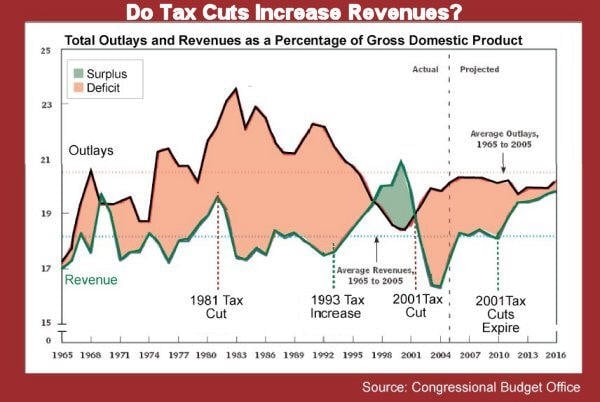

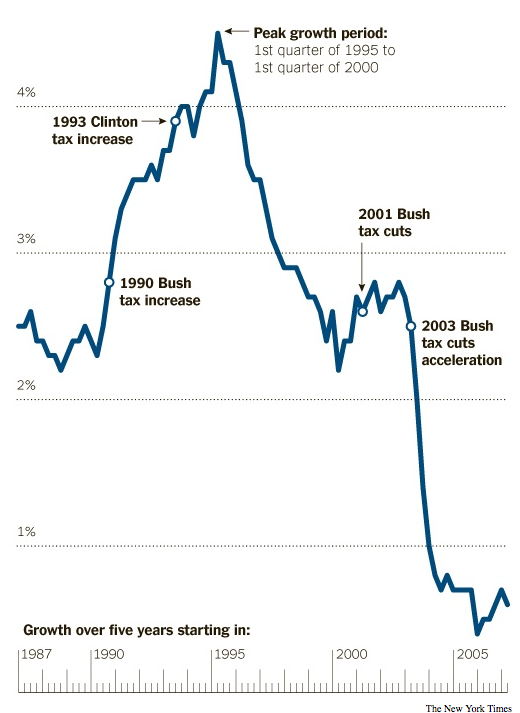

Heres how tax cuts affect the economy - YouTube. Yet most economists seem to agree that tax cuts really do provide a stimulus. Proponents argued that the tax cuts would spur economic growth that would more than pay for the loss of revenue.

It went into effect on Jan. The payroll tax is the money thats automatically deducted from employees paychecks for Social Security and Medicare. But would cutting those taxes now help juice the economy.

The concept above is known as Fiscal Stimulus and all economists agree at least on the surface that tax cuts stimulate the economy. This means that you can lower taxes and generate more tax. But how much is a major question and will it be sustainable.

Heres what we can and cant say about how its impacted the economy so far. Believe it or not having tax cuts are beneficial to both the people and the government. In general tax cuts boost the economy by putting more money into circulation.

People who want to save more can use theirs to buy up the new government bonds. The appropriateness and effectiveness of a tax stimulus depends on the underlying economic outlook-to indicate what is needed-and the budget outlook-to indicate the financial constraints. They also increase the deficit if they arent offset by spending cuts.

This philosophy also believes that if you need tax revenue for more essential things such as more school teachers or public safety that the best way to generate tax revenue is raising the revenue that is being taxed. While its hard to separate out the impact of the tax cuts from other forces acting on the economy a study last year by the Federal Reserve Bank of. The real reason may be that they provide flexibility.

So far it sounds like I am telling you that tax cuts will lead to an increase in consumption and jobs. Tax Cuts are Not that Black and White. Tax cuts are in reality helpful to the economy.

Its not all together clear that the job growth will. The Tax Cuts and Jobs Act TCJAreflecting President Trumps planwas ultimately signed into law on Dec. Monday is the first Tax Day under the new rules of the Tax Cuts.

In a 2012 survey of top economists the University of Chicagos Booth School of Business found that 35 percent thought cutting taxes would boost economic growth. Join me in todays.

The Effect Of Tax Cuts Economics Help

The Effect Of Tax Cuts Economics Help

Two Years On Tax Cuts Continue Boosting United States Economy Mirage News

Two Years On Tax Cuts Continue Boosting United States Economy Mirage News

How Have Tax Cuts Affected The Economy And Debt Here S What We Know

Question Can Tax Cuts Stimulate Economic Growth Economics Help

Question Can Tax Cuts Stimulate Economic Growth Economics Help

Tax Cuts Don T Lead To Economic Growth A New 65 Year Study Finds The Atlantic

Tax Cuts Don T Lead To Economic Growth A New 65 Year Study Finds The Atlantic

Tax Cuts Stimulate The Economy Best Image Of Economy

Who Benefits From Corporate Tax Cuts Evidence From Local Us Labour Markets Microeconomic Insights

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

Tax Cuts Don T Pay For Themselves Committee For A Responsible Federal Budget

More Tax Cuts For The Best Off Won T Help Wisconsin Economy Wisconsin Budget Project

Do Tax Cuts For The Wealthy Lead To Long Term Economic Prosperity Ppt Download

Do Tax Cuts For The Wealthy Lead To Long Term Economic Prosperity Ppt Download

Economists Extend Bush Tax Cuts For Wealthy Middle Class Sep 19 2010

Economists Extend Bush Tax Cuts For Wealthy Middle Class Sep 19 2010

Do Temporary Tax Cuts Only Have A Small Impact On Growth Committee For A Responsible Federal Budget

Do Temporary Tax Cuts Only Have A Small Impact On Growth Committee For A Responsible Federal Budget

The Effect Of Tax Cuts Economics Help

The Effect Of Tax Cuts Economics Help

Comments

Post a Comment